#1 Mortgage Lender in Lakewood CO | Win The Bidding War | Nathan Mortgage

Mortgage & Lender Options

Pre-Approval

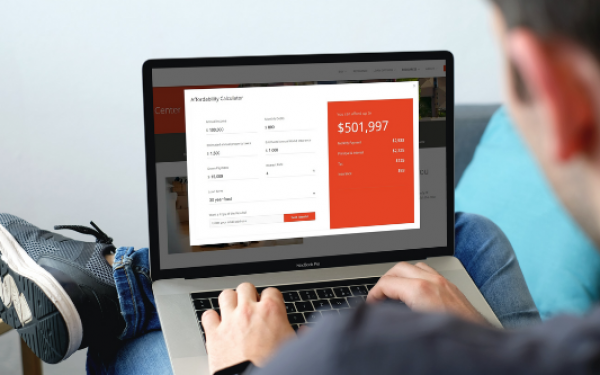

Determining Affordability

Before you can get preapproved for a loan, you need to determine what loan you can afford. It is helpful to consult with a trusted mortgage loan officer at Nathan Mortgage, who can look at your situation and determine the best estimated monthly payment for you. They will help you determine your best loan total given the current interest rates on home loans.

Getting Pre-Approved

After determining what you can afford for your estimated monthly payment, it is time to get preapproved for your loan by an equal housing lender. When preapproving home loans, one of the first things the lender looks at is your credit score. Your credit score will be a factor in the loan amount, loan type, and interest rate options.

However, if you have a low credit score, don’t despair! If your credit is less than spotless, Nathan Mortgage can offer simple repair options to help you get the green light on a preapproval. Your lender can also help you with a loan program, such as an FHA loan, which helps make homeownership possible for lower credit ratings.

What is Mortgage Pre-Approval?

Preapproval is the closest step you can take to affirm that your entire financial picture is sufficient to acquire a home loan. During the mortgage preapproval process, a loan officer will verify your finances by reviewing:

- Income Documentation

- Assets

- Credit Report

- Debts

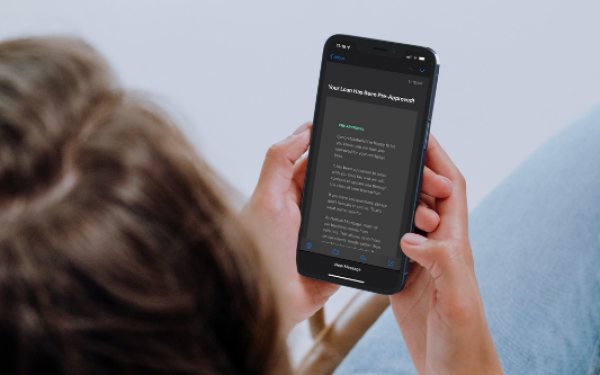

Pre-Approval Letter

Once you are pre-approved for a mortgage, you will receive a letter to present to sellers. The letter communicates to the seller that you are pre-approved, are serious about buying, and have lined up financing to close the deal. A well-written letter by a reputable lender can also paint a strong financial picture that could be the determining factor when competing with other buyers.

Home Buyer Pro Tip:

A mortgage lender may pre-approve you for more than you feel comfortable spending on a home. However, this does not mean that you will have to spend more when you are ready to purchase your new home. Keep your budget in mind when house hunting and purchase a home that you can afford comfortably.

Lender Options

Truly independent loan officers, not commission-driven.

Familiar brands, loan officers have sales quotas to meet.

Fin-tech startups with limited offerings, no in-person support.

Which Lender is Right for You?

Traditionally when you think of buying a home, the first idea that comes to mind is walking into a large financial institution and reaching out to a local banker to help you through the home loan process.

Where you go for home loans will affect your mortgage experience. It will also affect your interest rate and your estimated monthly payments.

While a bank loan officer can help with mortgage loans, including adjustable-rate or fixed-rate ones, they have limited loan options their bank offers. An online mortgage lender is also limited in their options, and the online process can be complicated if you have a low credit score. However, a mortgage broker is an expert in home loans and has access to more mortgage options for you. They can shop your loan across many lenders to get the best mortgage rates and payment options—improving your mortgage experience. Additionally, brokers often have less overhead. You get those savings in lower closing costs, lower interest rates, and reduced fees. That’s excellent customer service!

More About Big Banks

Big Big Banks mainly cater to borrowers with excellent credit and meet specific income/debt criteria. Banks also offer fewer rate and loan options. In contrast, devoted mortgage brokers will have accessibility to a wider variety of loan options, fewer overhead fees, and the backing of large lenders.

Mortgage Broker Vs. Big Banks: Know the Difference

Savvy Homebuyers Are Turning to Mortgage Brokers

When it comes time to get your mortgage, you won’t come up short of finding an establishment eager to accept your application. The two most commonly used options are Mortgage Brokers and Big Banks.

Knowing the best fit for your purchase will depend primarily on your goals and finances. Both options will help you obtain a loan and can assist you with coming up with the funding to acquire your home, so long as your income, debt to income ratio, and credit rating meet their qualifications. Big Banks typically have stricter lending criteria and fewer loan options. In contrast, Mortgage brokers offer better rates, a wider variety of loan options, and work with borrowers with lower credit ratings or challenging finances.

Mortgage Brokers

Unlike big banks, mortgage brokers work with multiple end-investors who compete for the borrower’s loan, which means better rates, solutions for challenging financial pictures, and more options (think— Cash Compete, Lock & Shop, ITIN Loans, Bank Statement Loans, etc.)

Mortgage brokers provide more support to home buyers in a hot market. They do this by working closely with your realtor to make you the most appealing offer via faster closings, cash offer loans to make you appear as a cash buyer, and even calling the selling agent to communicate your solid financial standing. Turning away from big banks and looking into independent mortgage brokers doesn’t mean you will be downgrading to a smaller lender. In fact, mortgage brokers have access to more end-investors which means they shop your home loan with the same big players but more of them and can access better prices and rates.

Mortgage Brokers: Pros & Cons

-

Knowledge and expertise in the field.

-

Offers a variety of options for loans.

-

Improved loan counseling and proposals.

-

Will shop rates with multiple lenders.

-

More lenient credit requirements.

-

Faster closings.

-

You may be less familiar with the brand.

-

Less consistency from one broker to the next.

Big Banks

Some banks will offer their clients specific benefits or discounts to existing customers and might have branded loan choices tailored to their customers.

They will also up-sell other costly financial products during the loan process, such as credit cards, peculiar checking and savings accounts, and other products in exchange for more appealing mortgage terms. Big bank loans usually come with stricter lending standards making it difficult for most to qualify.

Big Banks: Pros & Cons

-

Could offer specific benefits to existing customers.

-

Buyers may have a pre-existing relationship with a banker.

-

Has final say based on your banking history.

-

Strict credit requirements.

-

Fewer loan options.

-

Upselling of additional unnecessary financial products.

-

Higher interest rates.

-

Longer closings.

Mortgage Options

There are many factors to consider that could affect your estimated monthly payment.

It’s essential to have a lender who will give you excellent customer service so that you get the loan you want and have a positive mortgage experience.

Things to Keep in Mind:

-

The interest rates of fixed-rate mortgages do not change throughout the life of the loan.

-

Adjustable-rate mortgages (ARM) are often more complicated than a fixed-rate mortgage.

-

An Adjustable-rate mortgage is typically set below the market rate in comparison to a fixed-rate loan and will typically rise or fall during the life of the loan.

Adjustable-rate loans start at a lower interest rate than other mortgage loans, but after the fixed-rate period, the interest rate will adjust with the current market for the remaining life of the loan. After the fixed-rate period, your APR may increase significantly, affecting your monthly payment.

With a fixed-rate home mortgage, the interest rate remains set for the entire term of the loan. It does not change and does not have a fixed-rate period.

Home loans have various repayment periods, called the loan term. The term of the loan will affect your monthly payment.

Conventional Loans

If you have less than a 20% down payment, you need mortgage insurance, which increases your monthly payments. You don’t have to pay mortgage insurance over the entire life of the loan; once you pay 20% of the loan principal, the mortgage insurance goes away, and your monthly payments go down.

FHA Loans

There will always be mortgage insurance, regardless of your down payment amount. You can remove it in the future by doing a refinance.

Mortgage rates are synonymous with the interest rate on home loans and will significantly impact your monthly mortgage payment.

This is sometimes one of your loan options, but not always. This is really only available on refinances. FHA loans do allow the UPMIP (upfront mortgage insurance) to be rolled into (financed) by the loan but not the rest of the closing costs.

Final Loan Approval & Closing

After you’ve gotten preapproved and had your offer accepted on a new home, it is time to finalize your loan.

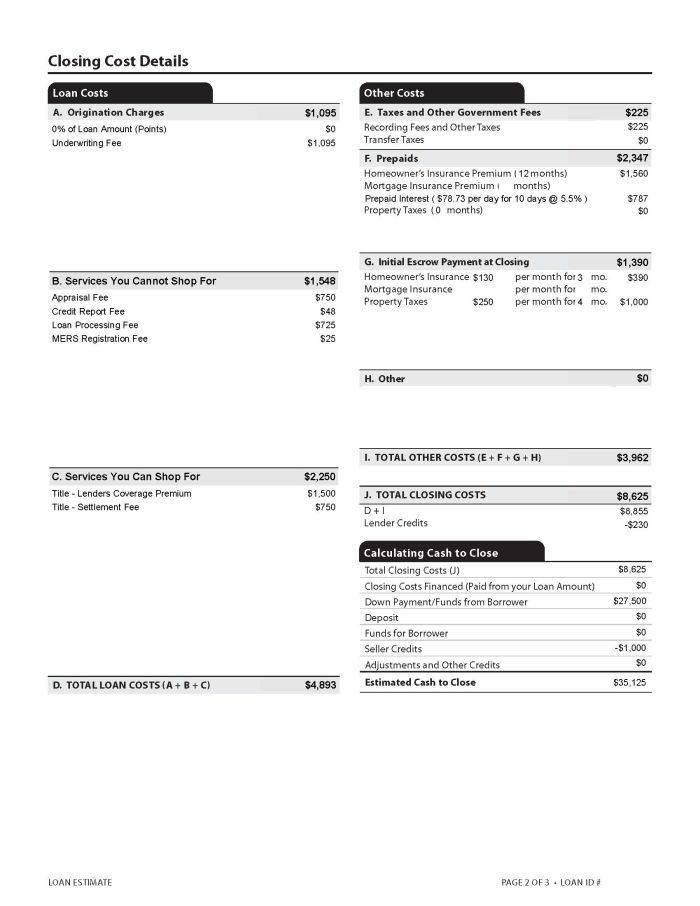

There will be closing costs to consider. These include fees for originating the loan, title insurance, and appraisal fees, among other things. Be sure you keep your closing costs in mind when considering how much money you need to buy your home.

At this point, your estimated monthly payment becomes a solid number. If you are getting a fixed rate on the current loan, your interest rate will be locked in for the life of the loan.

Before getting the keys to your new home, you’ll also have to budget for closing costs. These are the expenses and fees associated with securing a loan for your home outside of a down payment. The average is usually around 3 to 6% of the loan amount and may include credit report charges, loan origination fees, and appraisal fees. Bottom line, closing costs will play a sizeable role in your home buying experience.

Typically, the closing will happen within 30 days after signing the purchase contract. Faster closings are available in some circumstances— Nathan Mortgage Cash Offer Loans close in as few as 10 days, and some loans can close as fast as 14-21 days. Once the purchase contract is signed and you have received your “clear to close” from the lender, you will attend the closing appointment. Be sure all the documentation you have acquired is stored in a safe place, and be sure to take that obligatory photograph of you at closing!

Congratulations! Time to close on your house and take your final step towards home ownership, and getting familiar with who will be present at closing can help create a more comfortable atmosphere during the process of signing the final documents. Depending on preference, the faces you will most likely see are:

- The Buyer (That’s You)

- The Buyer’s Agent

- The Buyer’s Lender

- Seller

- Seller’s Agent

- Closer

Typically, the closer is going to be seated at the head of the table so that the closer and everyone involved can sit on one side; that way, paperwork can be easily passed down. Closing is a two-part process. The first part will include the closing on your loan. The second part will involve closing on the existing real estate (this usually is pretty quick with a small amount of written material). Most of these documents will be for the assessment of taxes. The closing of the loan will be a little more involved, especially if there is a government loan like FHA, USDA, and VA type loans. You should expect to sign similar or duplicate versions of the documentation. After all the ink is dry, the closer will request your cashier’s check or confirm that the wire for your down payment has been received. After that, the finances will be with the title company at the closing. After that, the title office will gather all the documents the lender will need to see to give the “green light” to dispatch the payment to the seller.

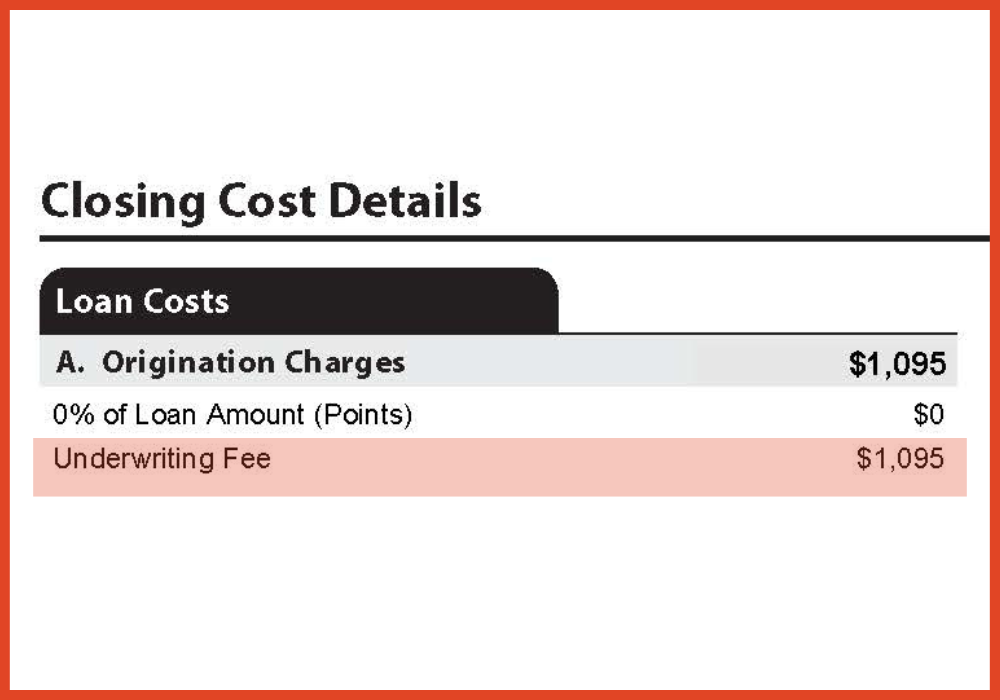

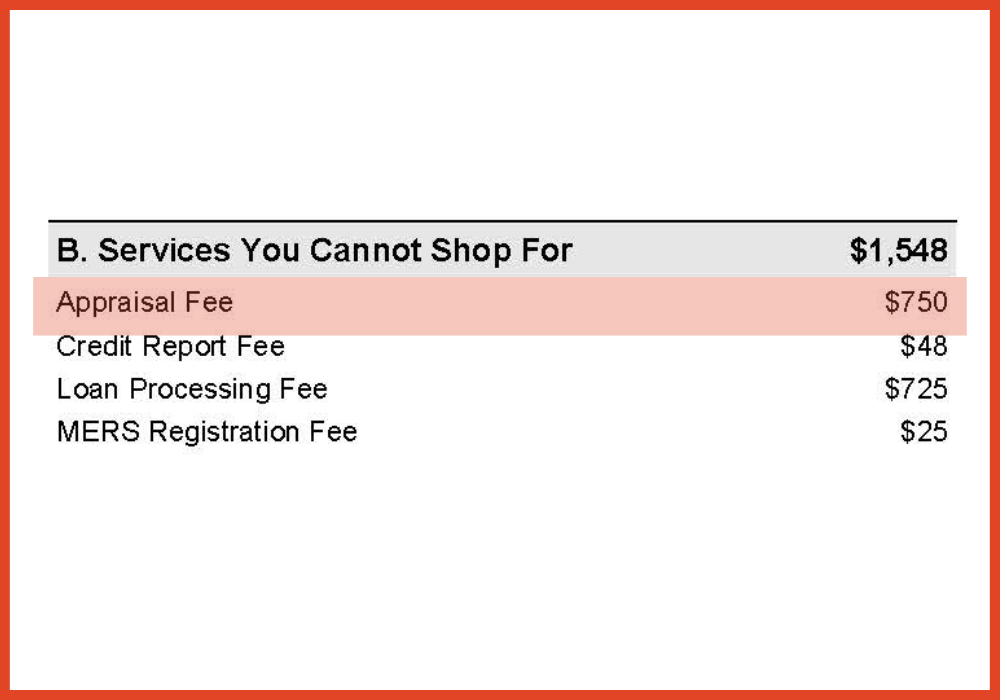

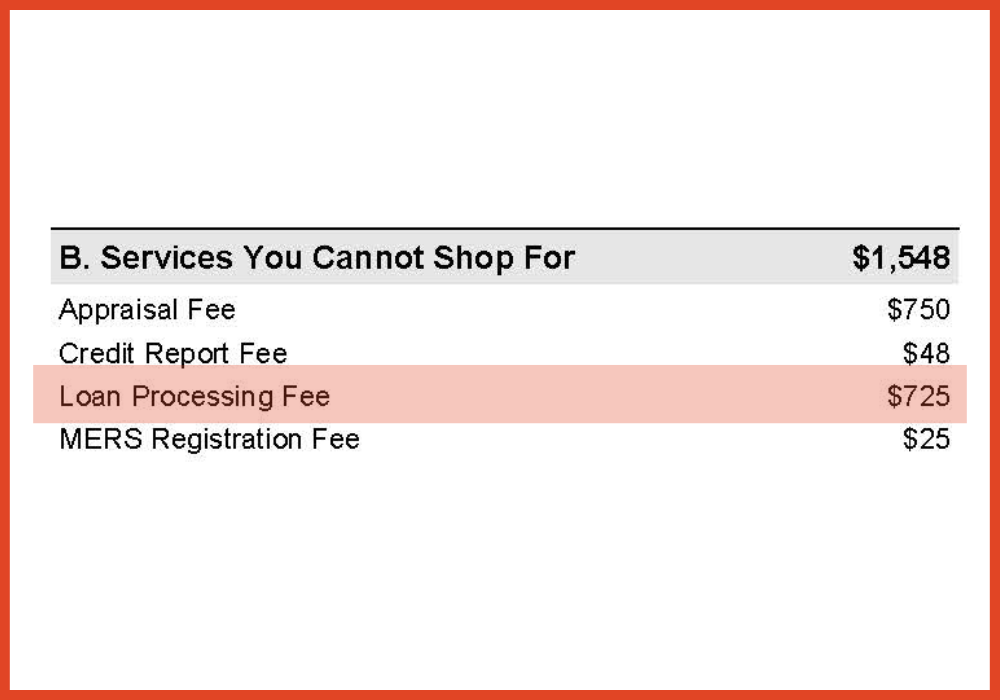

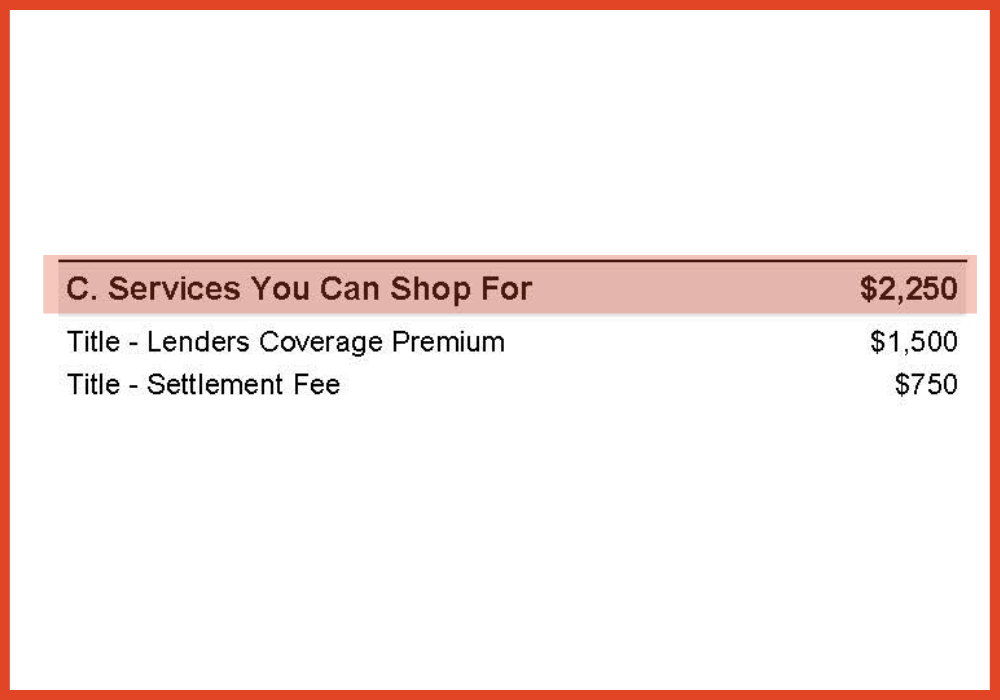

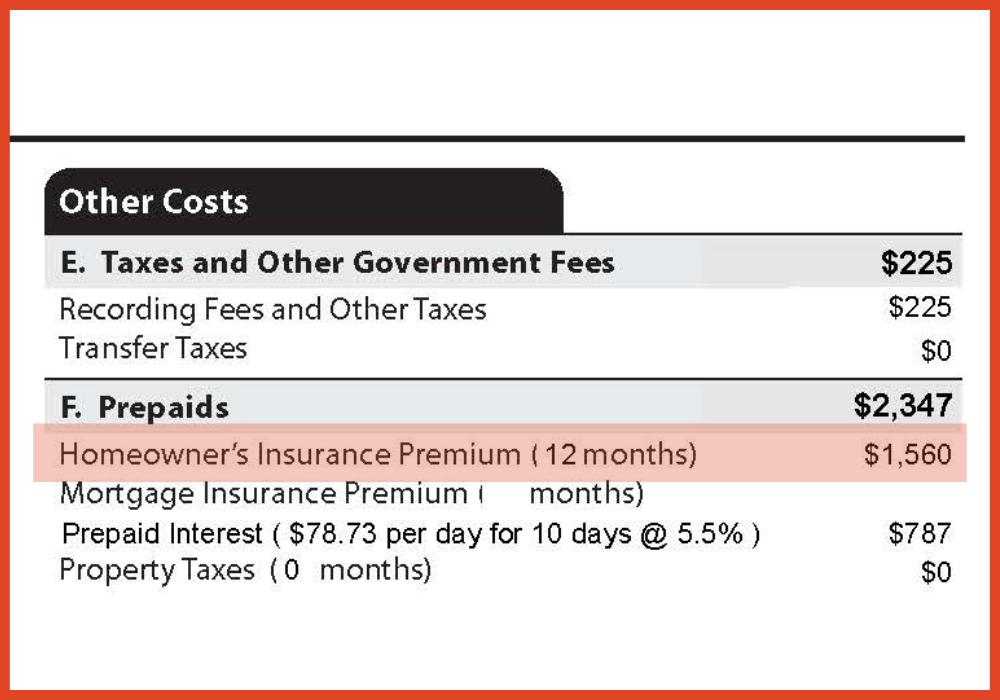

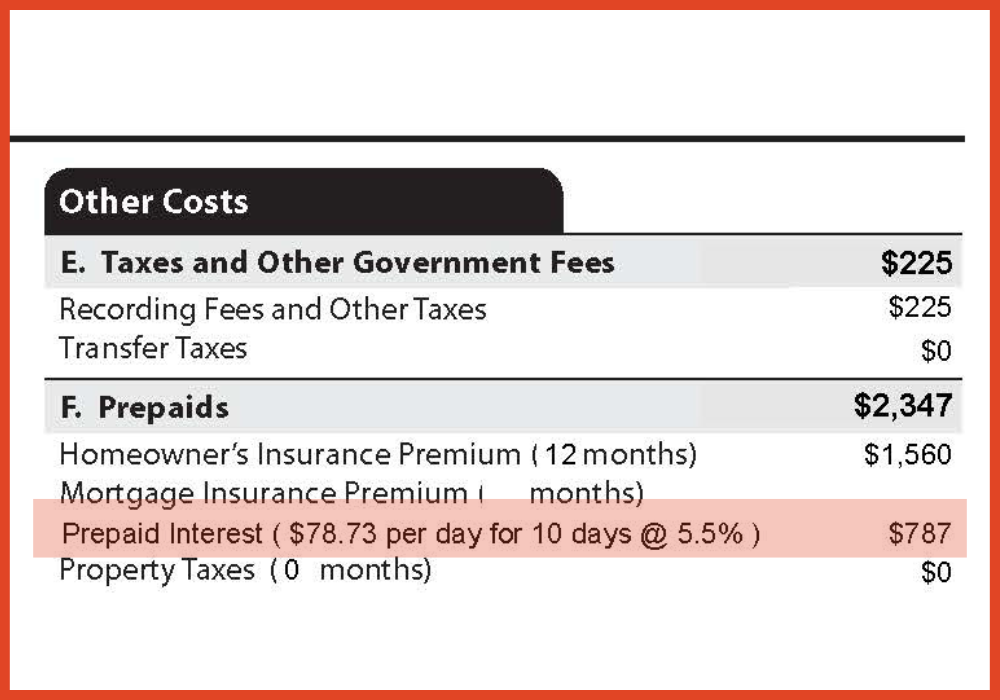

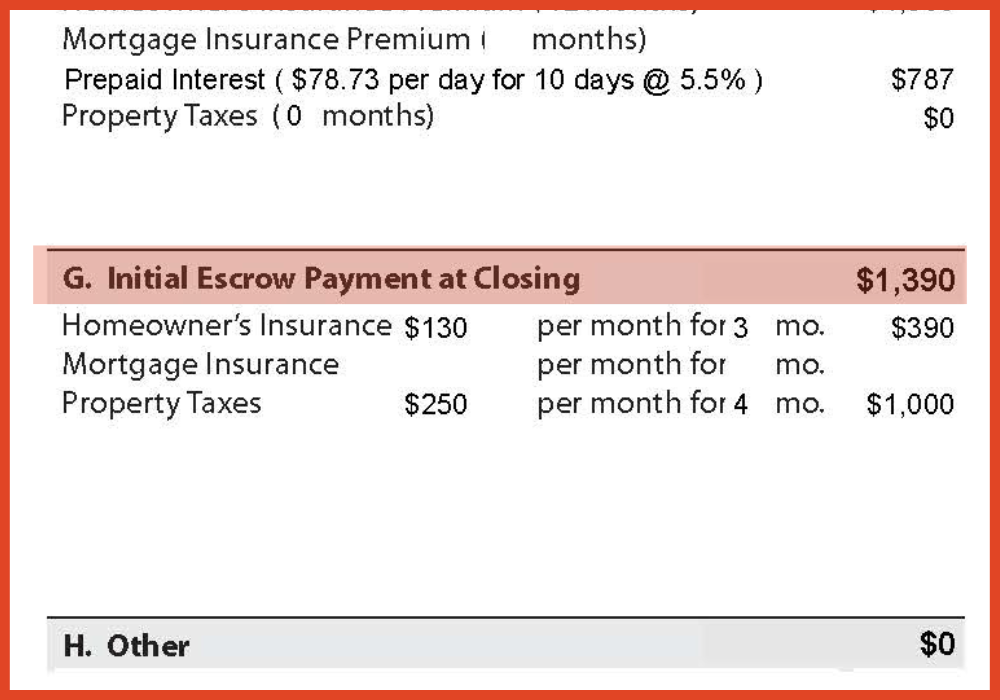

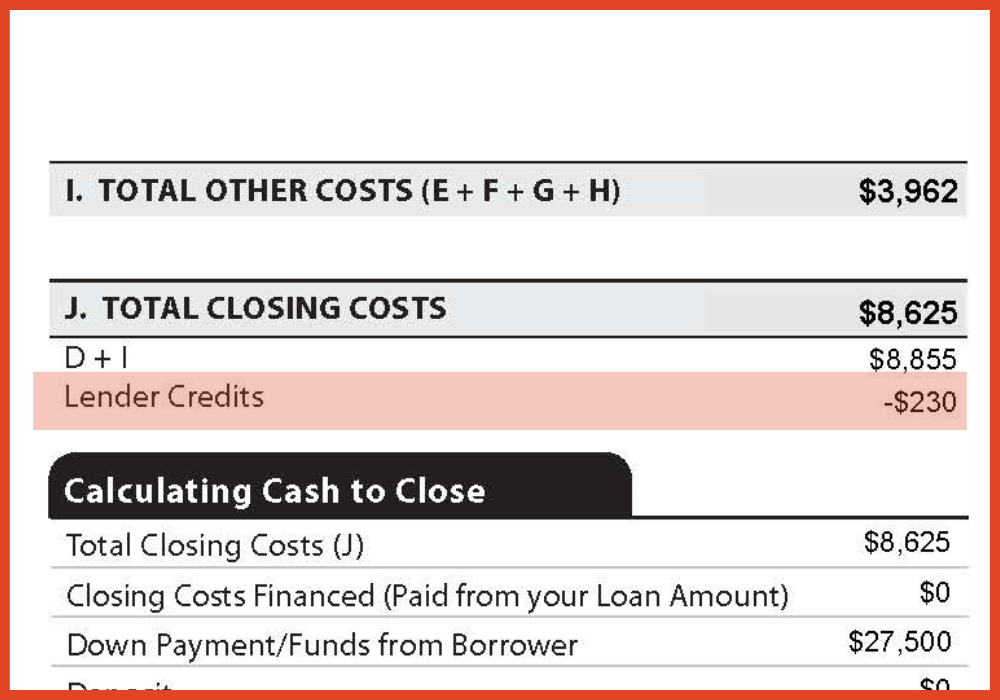

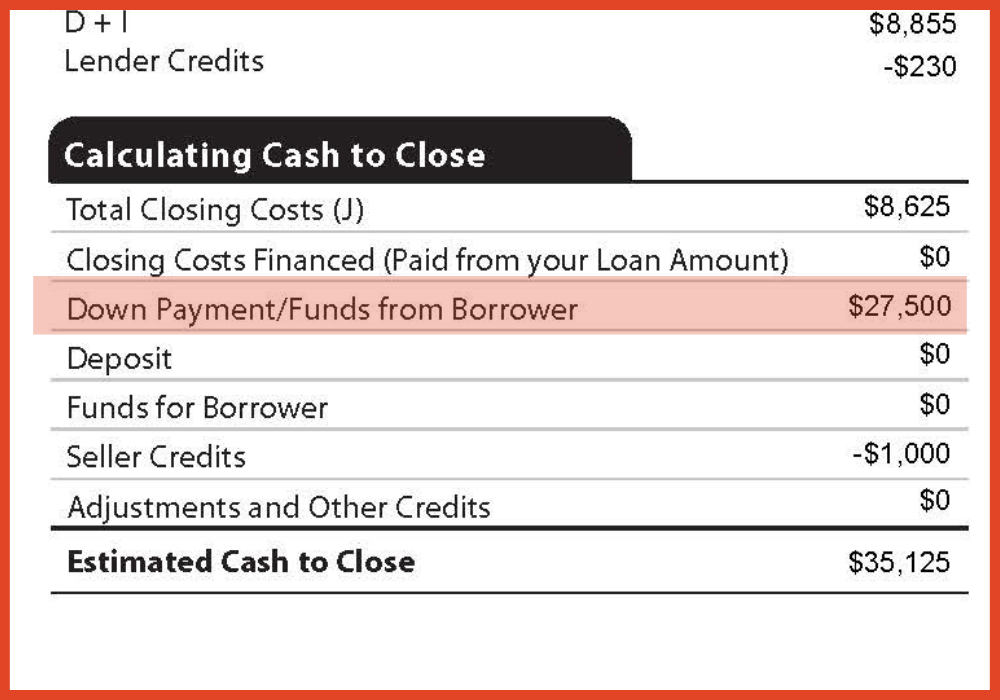

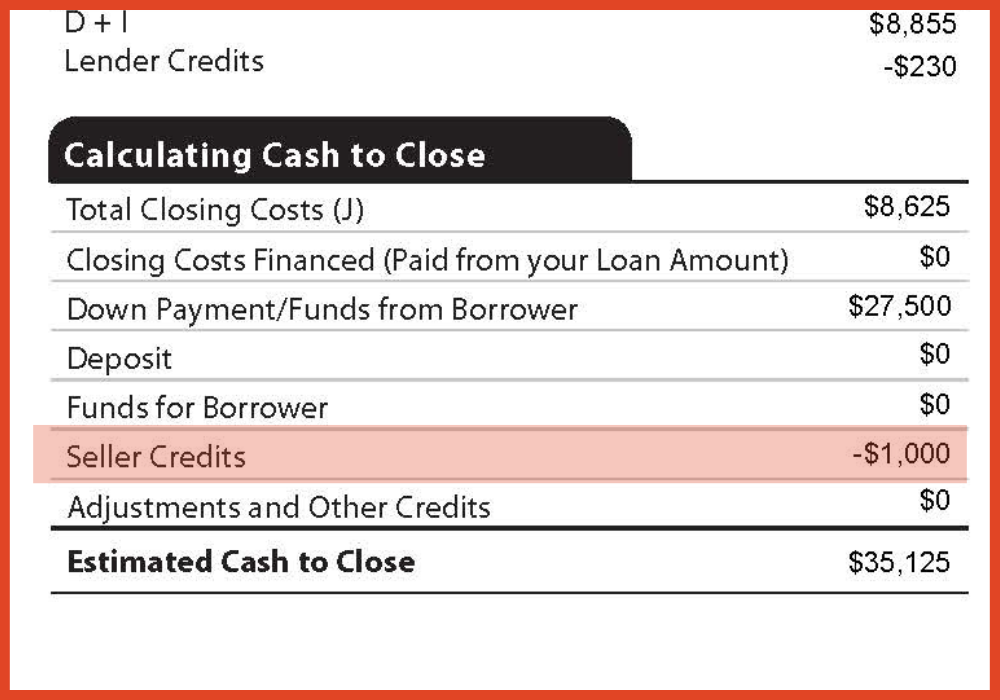

Closing Costs At a Glance

This is the fee the lender charges for the cost of underwriting your loan.

This is a standard estimate for a basic appraisal. If there is a shorter timeline, there would also be a rush fee.

This is the processing fee for the third party processor used. The processor collects documents, orders the appraisal, and works to provide a smooth loan process with the lender.

The heading “Services You Can Shop For” is misleading. As a buyer, you don’t get to choose your title company. The Seller does. These costs are estimates as each title company charges are a little bit different. You will pay actual cost of what the title company charges. We have no control over this amount either.

The lender requires that your home owners insurance policy is paid for the full year upfront, at closing. This is an estimate of what your costs. Actual cost will depend on the policy you choose when you shop for your insurance provider.

This is the cost of the interest for the day you own the home that aren’t covered by the first mortgage payment.

Your lender collects a portion of your taxes and home owners insurance each month and then pays them out of the pool of money collected throughout the year. That pool of money is called your “Escrow Account.” Because taxes and insurance may change over time, your lender is allowed to keep a margin of two months payments to adjust for those changes. This charge represents the payment of the first month and the two months required to establish that escrow account. These amounts are estimates. You would pay actual costs of the taxes and insurance on the property of your choice.

When available, a lender credit will help cover closing costs. Availability depends on the market pricing and current interest rates.

This is your down payment, a percentage of the purchase price. Whatever you pay in earnest money will be credited towards this amount.

In states where taxes are paid in arrears the seller credit represents an estimate of what the seller would pay you for the property taxes they would have paid on the upcoming tax bill for the time they were in the house prior to selling it to you. This will help offset the costs of the prepaid taxes that must be paid at the time of closing.

Home Equity Line of Credit (HELOC)

Once you own some equity in your home through making payments on your current loan, you can take out a home equity line of credit.

A home equity line of credit often has a fixed rate of interest. It doesn’t have to be repaid until you use it, like a credit card. Your monthly payment will be based on the interest rate and the credit you use.

-

If you already own a home and want to purchase a second home, a trusted mortgage broker can help determine if taking a home equity line of credit would be a good way to finance the down payment.

-

While your mortgage will usually have a lower interest rate than a HELOC, HELOCs have payment options such as interest-only periods, which provide more flexibility for budgeting your monthly payment. A reputable mortgage broker can provide unbiased advice about the pros and cons of borrowing a smaller amount through a HELOC vs a larger mortgage.

-

A home equity line of credit can be used for home repairs or to pay off higher-interest loans, among other things. You can get personal loans for these needs, but home equity rates are usually lower than the interest rates on personal loans.

Get Started

Nathan Mortgage, a Lakewood mortgage broker provides mortgage loans and mortgage refinancing in Colorado, Illinois, Florida, Tennesse, and Texas.